What does the Chinese Super League's ambition mean for MLS?

In the world order of soccer leagues, both Major League Soccer and the Chinese Super League could be categorized as "aspirational." Each league is attempting to break into the upper echelons of the game, but the means by which they attempt to achieve their respective goals could not be more different.

MLS has been all about slow, steady growth in an already-saturated sports market. Its centralized, single-entity structure -- whereby all player contracts are held by the league, and not individual teams -- is designed to provide stability in the process.

Chinese soccer, at the behest of the country's president, Xi Jinping, has engaged the capitalist hyperdrive and launched itself well past light speed. Since the start of the year, it seems that not a week has gone by without the CSL setting another transfer record.

First it was Chelsea midfielder Ramires heading to Jiangsu Suning for $36.1 million. Then it was Guangzhou Evergrande's $47.1 million acquisition of former Atletico Madrid striker Jackson Martinez. That was then topped by Jiangsu Suning obtaining Shakhtar Donetsk attacker Alex Teixeira for a whopping $56.1 million, a fee that proved to be too much for even Premier League side Liverpool.

And now it appears that the CSL's spending spree has come to MLS. Sources confirmed to ESPN FC on Sunday that Obafemi Martins is on the verge of moving from the Seattle Sounders to Shanghai Shenhua, although for a more modest transfer fee of $3 million.

Attendances and television revenues have followed suit. The CSL averaged more than 22,000 fans per game last season, and recently signed a $1.3 billion television rights deal over five years.

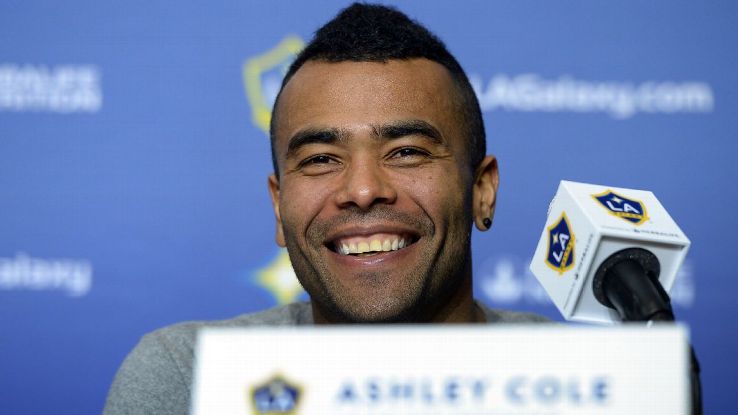

MLS, meanwhile, averaged more than 21,500 per game, and is currently in the midst of an eight-year, $720 million television deal. on the transfer front, the contrast is even more striking. High-profile players like Ashley Cole and Nigel de Jong both were acquired by the LA Galaxy in the offseason, but on deals that were free transfers and involved pay structures that saw their previous clubs pick up the vast majority of their salaries. Sources have told ESPN FC that the Galaxy's portion of Cole's salary is just $300,000, while De Jong's is $500,000.

For Mads Davidsen, an assistant coach under Sven-Goran Eriksson with Shanghai SIPG, the influx of top players isn't a surprise. Last year, Shanghai acquired Ghana captain Asamoah Gyan while Guangzhou Evergrande obtained Brazilian midfielder Paulinho from Tottenham.

"I've been here for four years, and I've seen the development, step by step," Davidsen told ESPN FC via telephone. "This isn't the first window where Chinese clubs buy big players. So for me this has been a normal step forward in the development of Chinese football. But I think it's been a little bit of a shock for the football world because people don't normally follow China so they don't see this development."

How has this happened? Much of the momentum has been created by President Xi, who is an unabashed fan of the game. Last year he announced a mandate for the country to invest heavily in soccer, with an eye toward hosting and one day winning a World Cup. His plan is to develop a domestic sports economy that would be worth $850 billion by 2025.

"For most teams and leagues, this spending wouldn't be sustainable unless there was a corresponding uptick in revenue," Michael Colangelo, the assistant director of the Sports Business Institute at the University of Southern California's Marshall School of Business, said via email. "Eventually expensive moves need to be paid for or teams would spend themselves into insolvency.

"That's not the case in China. If an owner wants to spend -- and lose money -- on their team to bring in the world's best talent, they can try to make it up with an increase in attendance, concessions, gear and TV rights. However, China's economy is structured differently to where this type of spending curries favor with the government and could increase revenue for other non-sport revenue business ventures."

In a bid to acquire as much expertise as possible, China is also investing funds outside the country. Chinese billionaire Wang Jianlin owns a stake in Atletico Madrid, and the Miami Herald reported earlier this week that a Chinese consortium was among the candidates to purchase a majority stake in David Beckham's MLS franchise.

So what does this mean for MLS? The sums being thrown around by Chinese teams would seem to indicate that there wouldn't be much head-to-head competition. When it comes to star players, MLS has tended toward older performers closer to the end of their career, while China is targeting players closer to their prime.

But the Martins deal has dispelled that notion to a degree, and one MLS team executive indicated that Chinese clubs were actively pursuing other MLS players as well. And given the vastness of the Chinese market, the CSL is shaping up to be a different kind of competitor than, say, the Qatari Stars League, where former Sporting Kansas City midfielder Krisztian Nemeth recently landed.

This development can be looked at one of two ways. MLS has made no secret of its ambition to be one of the top leagues in the world by 2022. It's easy to dismiss such aims as mere marketing spin. At this point, it's not even the top league in CONCACAF. But there's no denying the fact that MLS wants to grow in all areas. If the CSL continues to poach MLS' top players, that could create some downward pressure in terms of how high MLS can climb.

Then again, the funds acquired from such deals could provide some valuable working capital for MLS to acquire better players and thus raise the level of play. In that scenario, both sides could win given the vastness of the world transfer market.

That would also allow MLS to retain its ethos. The league has survived into its 21st season in part because of its methodical approach, which has included an extensive investment in stadiums and youth academies. When the league began with 10 teams in 1996, none of them were playing in their own stadium. Now 14 such venues have been built, with another two on the way.

On the youth front, the Wall Street Journal reported last year that MLS spent $40 million on youth development. Every team now has its own academy, with several players like DeAndre Yedlin (then of Seattle) and L.A.'s Gyasi Zardes making the jump to the first team.

There have been some growing pains, of course. Television ratings have long been a point of concern, even though last year they were up four percent on ESPN, three percent on UniMas and 40 percent on Fox. That said, the three networks averaged between 197,000 and 249,000 viewers each match. While U.S. stars like Michael Bradley, Clint Dempsey and Jozy Altidore have all returned to MLS in recent years, the sale of Martins and U.S. international defender Omar Gonzalez to foreign clubs illustrates how much of a balancing act there is between obtaining and selling some of the league's best talent.

When asked about the rise of the CSL, MLS deputy commissioner Mark Abbott didn't sound like a man who was all of a sudden rethinking the league's approach.

"Obviously we are watching with interest what they do," said Abbott about the CSL. "They've been very active in the player market, and I think they're very serious about trying to build their league. We are too, and we've been at it for a long time. There are a lot of elements that we're continuing to work on; players, quality of play, stadium environments, supporters culture, all those things go into a league being successful."

Jamaican international Ryan Johnson is one of the few players to have played in both leagues, having spent time with the San Jose Earthquakes, Toronto FC and the Portland Timbers before signing with Henan Jianye during the 2014 season. Johnson is of the belief that MLS is the more technical league, though the CSL had its challenges.

"I can definitely say that it wasn't at the same level as MLS, but the level was pretty good," said Johnson. "All the foreign players on each different team are pretty good players. The Chinese players, they work pretty hard. Everyone is really fit, and it's a real battle every game. MLS is a special beast when you think about all the different players, all the difference [nationalities], the athleticism. There's a lot of different things that can be thrown at you in China, but the majority of the time the players are very similar in terms of the league and athleticism. It was still definitely challenging, and still a pretty good level for sure."

Not everything has been rosy in the CSL, particularly on the organizational side, though matters are improving. Back in 2012, the Chinese government cracked down on corruption, resulting in dozens of convictions, thus easing the way for investment to flow back into the game.

While Johnson said that his paychecks did arrive on time, that wasn't always the case on other teams. It was a reality highlighted when Didier Drogba and Nicolas Anelka played for Shanghai Shenhua in 2012, and left in 2013 when salaries reportedly went unpaid during a shareholders dispute.

For all the talk of high-priced talent coming in, it's worth remembering that there is a limit of five foreigners per team, with one of those coming from an Asian country. Much like MLS, the backbone of the league is domestic players, and Davidsen feels this is an area where Chinese football has a ways to go.

"The current Chinese players in the league haven't had a good football education," he said. "Of course, you can't gain that when you're 22, and suddenly develop massively. The next generation will hopefully have a much better education because now it's been taking care of much better football education in China."

China's investment in youth academies remains a work in progress as well. Johnson said the uptick in resources is noticeable, but he wasn't necessarily blown away by what he saw.

"I wouldn't say impressive, but I'd say standard," he said. "If you're trying to make it in the global world of football, you definitely have to invest in your future. They're building facilities, updating facilities; they're investing into their youth with youth coaches. It's all a process and I definitely see that they're doing what they're supposed to do."

Johnson added that the biggest advantage MLS has over its Chinese counterpart is what has long attracted foreigners to the league in the first place: the chance to live in North America and enjoy the lifestyle that comes with it in relative anonymity.

"For a lot of players, especially when you're dealing with the aspect of family, that's a huge thing," he said. "A guy like Steven Gerrard can be in L.A. with his wife and kids and be around L.A. and the Hollywood atmosphere. Compared to a team in China like Beijing or Guangzhou, it's a completely different kind of atmosphere. That's the one thing that MLS has is location. And the atmosphere in the stadiums is getting really good now. It's sold-out stadiums everywhere. It's a good environment for players to feel like a professional but at the same time get a really good life off the field for their families."

But in any discussion of the CSL, the conversation inevitably returns to how sustainable this level of growth -- and spending -- actually is, a topic that these days MLS rarely has to address. Davidsen sees no let up in the amount of money flowing into the CSL.

"This for me is maybe the biggest misunderstanding from the western world," he said. "Of course, I can't promise that this will continue for the next 15 years, but you have to understand the focus on football here in China, and how political influence has a big impact on where companies are putting their investment."

But while the influence of Xi counts as a strength, it can also be looked at as a weakness. Davidsen notes that Chinese presidents have historically linked their names to big, grand projects. Xi's interest in soccer is part of a grander plan called the "Chinese Dream". If Xi were to be removed from power for whatever reason, his successor could easily shift his priorities elsewhere, though Colangelo added that much depends on how much time Xi is given.

"If Xi were to fall out of power it could put some stress on those other business relationships, and lead to a decrease in spending," said Colangelo. "But contracts and business deals run on a multiyear time frame. By that time, even with a regime change, China could have created a strong development system and the teams may even start to leverage their stars and teams to make them fiscally viable. It could go either way, but this is like giving a growing league and the world's largest population soccer steroids. It may not need long time-frame to grow the game to sustainable levels."

For now, the CSL's spending continues unabated while MLS soldiers on with its approach. Time will tell which strategy -- or perhaps if both -- will ultimately win out.

Jeff Carlisle covers MLS and the U.S. national team for ESPN FC. Follow him on Twitter @JeffreyCarlisle.

'Football World' 카테고리의 다른 글

| JACK REYNOLDS: THE FATHER OF AJAX AMSTERDAM (0) | 2016.02.19 |

|---|---|

| HOW AMSTERDAM CHANGED THE WORLD OF FOOTBALL FOREVER (0) | 2016.02.19 |

| [人사이드] 김호의 축구論 “가치를 알고 철학을 세워라” (0) | 2016.01.29 |

| ‘축구 선진국’ 노리는 MLS의 '특별한 도전' (1) | 2016.01.28 |

| Deloitte Football Money League 2015 (0) | 2016.01.22 |